Chapter 2 Customs duty privilege, exemption and other privileges

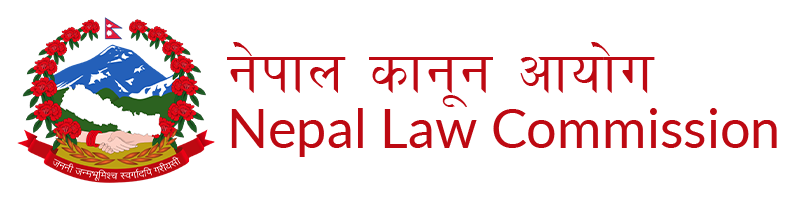

3. Diplomatic privilege or duty privilege may be granted :

( 1) As per the Sub-section (1) of Section 9 of the Act, those institutions, officials or persons., who are entitled to diplomatic privilege or duty privilege, shall apply in the Ministry of Foreign Affairs declaring the descriptions of the goods, price and quantity in order to avail of such privileges.

(2) While making inquiry on the application received, pursuant to Sub-rule (1), if the Customs privilege or duty privilege need to be granted, the Ministry of Foreign Affairs shall forward two copies of recommendation form as prescribed in Schedule to the Department.

(3) Upon the receipt of the recommendation form pursuant to Sub-rule (2), the Department shall forward one copy of recommendation form for execution to the Customs office or Duty Free Shop.

(4) Upon the receipt of the recommendation form pursuant to Sub-rule (3), concerned Customs office or Duty Free Shop shall grant diplomatic privilege or duty privilege to the concerned institution, official or person as recommended in the form.

(5) Concerned Customs office or Duty Free Shop shall submit the description form of diplomatic privileges or duty privileges as per Sub- rule (4) to the Department and one copy of such description form shall be kept for record in the office.

(6) For the purpose of this Rule, the Ministry of Foreign Affairs shall provide at a prior date the specimen signature of the authorized official to the Department, who shall recommend the diplomatic privilege or the duty privilege.

4. Formality to be fulfilled regarding duty privilege for sending goods from one part of Nepal to another part of Nepal through foreign territory :

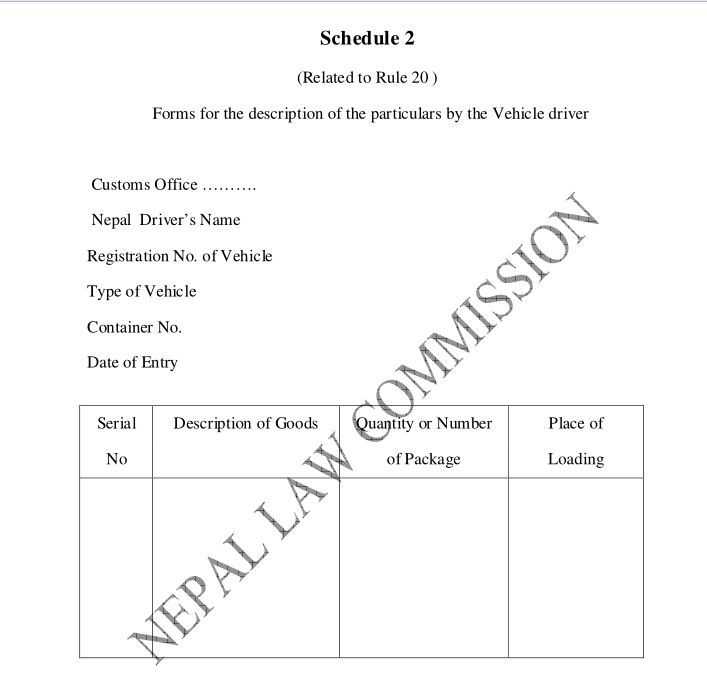

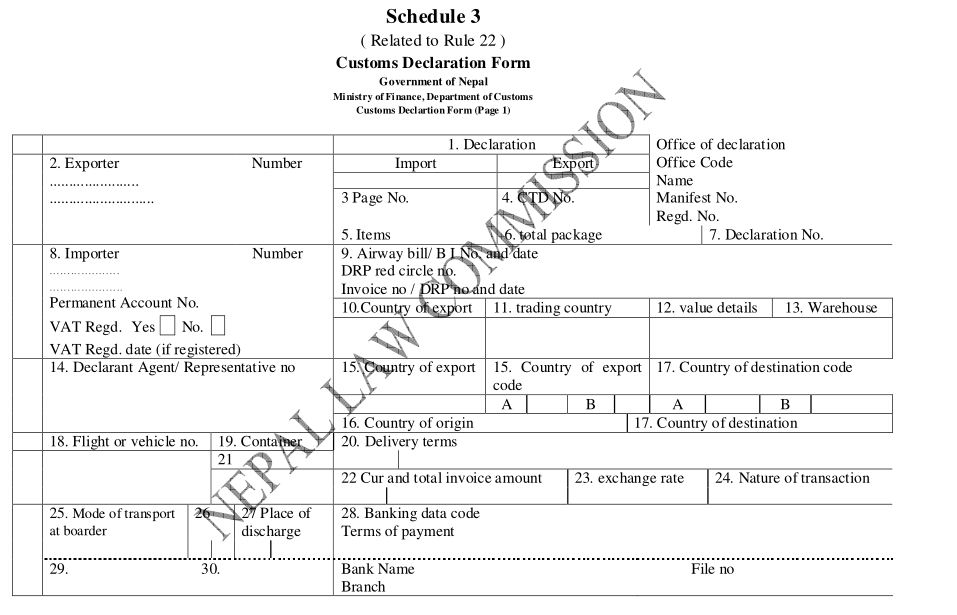

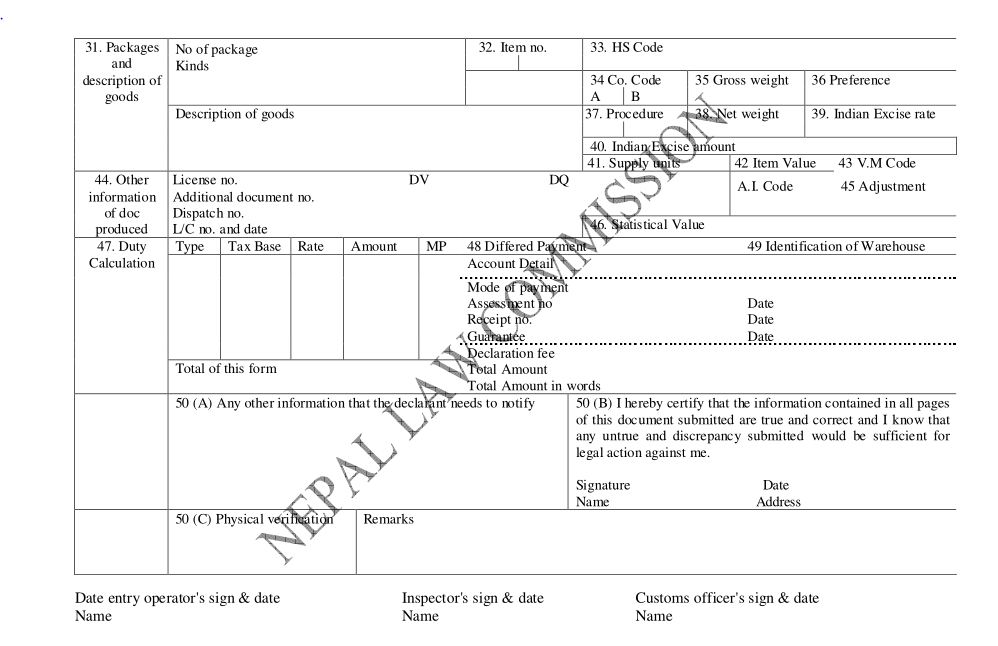

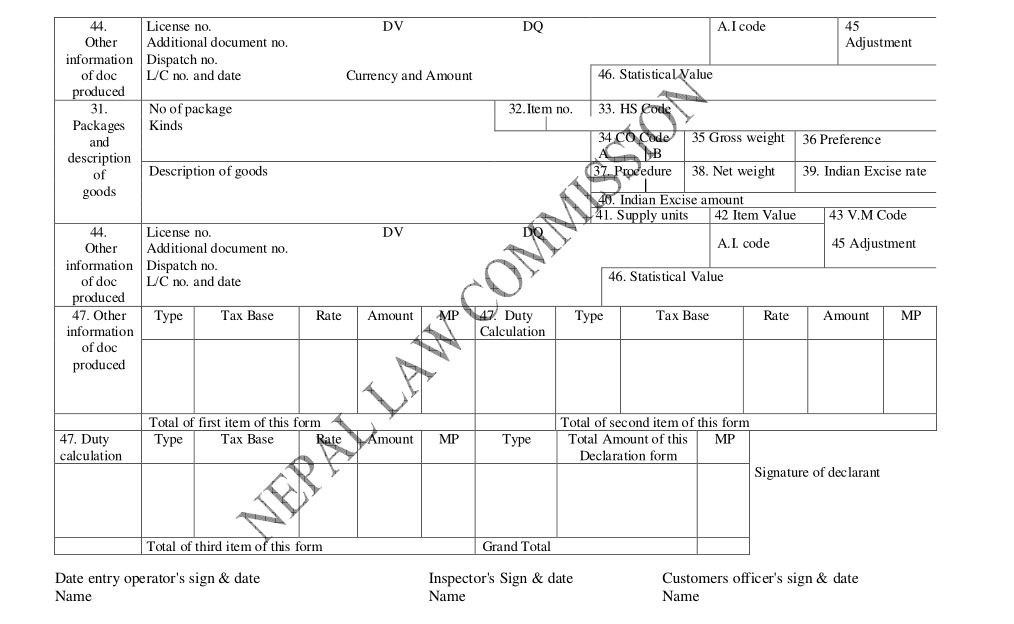

(1) In case of sending Goods from one part of Nepal to another part of Nepal through foreign territory, the owner of goods shall submit declaration form containing full particulars to the concerned Customs office. Such declaration form shall also clearly specify the Customs office from which the goods reenter into Nepal.

(2) In case a declaration form as referred to in Sub-rule (1) is received, the Chief of the Customs Office shall not permit the movement of such goods through foreign territory if cheaper or more convenient means of transport are available for carrying them through the territory of Nepal itself or that it is advisable to send such goods through the territory of Nepal itself from the viewpoint of the Customs administration also.

(3) Upon making an inquiry the case of a declaration form as referred to in Sub-rule (1), the Chief of the Customs Office shall permit the movement of such goods through foreign territory by keeping record of the duty or Customs duty on deposit, specifying such goods, affixing Customs seal, recording the transit time on the declaration and submitting the same declaration to the owners of the goods, if he/she is satisfied that cheaper or more convenient means of transport are not available for carrying them through the territory of Nepal itself or that it is advisable to send such goods from the viewpoint of the Customs administration also,

(4) In case of goods banned to import in foreign country needs to be transported from one part of Nepal to other part of Nepal through their territory, the owners of the goods shall follow the prescribed Rules as incorporated in the Transit Treaty or Agreement between Nepal and the foreign country if there is any such Treaty or Agreement in effect.

(5) The Customs office receiving the declaration form of the Customs office authorizing to export goods as per Sub-rule (3) and the goods declared in the declaration form and transport document and found the goods as per the description in the declaration form shall allow the import of such goods without charging Customs duty by noting in the declaration form. The Customs office shall inform and send one copy of declaration form to the Customs office authorizing for export within Thirty days. Nevertheless, if the declaration form as issued by the Customs office to export is not presented to the Customs office, the importing Customs office shall allow the import by depositing the Customs duty equivalent. Nevertheless, if the declaration form as issued by the Customs office allowing export is not presented to the customs office, the importing customs office shall allow the import by depositing the customs duty equivalent.

(6) Upon the receipt of the information pursuant to Sub-rule (5), the export authorizing Customs office may allow the refund of the Customs duty or reconciled the record, if the circumstances warranted such action. Provided that, in case the goods permitted for the import of which has been granted are found to have .been partially imported, such amount of the Customs duty as is due on the goods which are not imported shall be deducted from the amount of the deposit. In case the goods are released keeping duty on record, such amount shall be collected from the owner of the goods within seven days.

5. Provision regarding duty privilege for sending Goods from one part of foreign country to another part of foreign country through Nepalese territory :

( 1) In case of sending Goods from one part of foreign country to another part of foreign country through Nepalese territory, the owner of goods shall submit an application in the Department of Customs specifying the reasons for using Nepalese territory, export and import Customs point and description of particulars of goods.

(2) In case the application as referred to in Sub-rule (1) is received, the Department of Customs, after the scrutiny of the application, shall permit the movement of such goods through Nepalese territory if the Department is satisfied. The Department may seek recommendation letter from the concerned Embassy or Diplomatic office located in Nepal, before granting such permission.

(3) In case permission is granted pursuant to the Sub-rule (2), the owner of the goods shall submit the declaration form with description of goods and the permission letter before the concerned Customs office. The name of the Customs office from which the goods are to be re-exported shall be mentioned clearly in such declaration form.

(4) In case a declaration form as referred to in Sub-rule (3) is received, the Customs Office, after certifying the description of goods with the seal of the office, shall permit the movement of such goods from one part of foreign territory to another part of foreign territory through Nepalese territory as per the decision of the Department inserting condition to reach in the specified place of exit within seven days in the declaration form and submitting such declaration form to the owner of the goods.

(5) In case the declaration form, the particular of goods and the transit permission as referred to in Sub-rule (4) is received, the Customs office, if the papers are found valid upon scrutiny and after noting in the declaration form, shall release such goods for export and a copy of such declaration form shall be notified to the import allowing Customs office within Three days.

(6) After receiving the declaration form, the import allowing Customs office shall release the deposit of Customs duty in case such duty is deposited. Provided that, in case the goods permitted for the import of which has been granted are found to have been partially exported such amount of the Customs duty as is due on the goods which are not exported shall be deducted from the amount of the deposit. In case the goods are permitted without keeping duty on deposit, the duty shall be collected from the owner of the goods.

(7) Notwithstanding anything contained in this Rule, in case of goods which are banned to import in Nepal, need to be transported from one part to another part of foreign country through Nepalese territory, provisions relating to the bilateral Treaty or Agreement between Nepal and respective countries shall prevail.

6. Provision relating to sending goods from one foreign country to another foreign country through Nepalese territory:

( 1) The Department may specify the Customs offices for the purpose of sending goods from one foreign country to another foreign country through Nepalese territory.

(2) In case of sending goods from one foreign country to another foreign country through Nepalese territory, the owner of goods shall submit goods and Four copies of application form in a format as prescribed by the Department and the declaration form in the concerned Customs office.

(3) On the scrutiny of the declaration form and prescribed form as referred to in Sub-rule (2) is found to be not containing the banned goods (contrabands), the Customs Office shall permit the movement of such goods within a period up to Fifteen days of transit period through Nepalese territory to the foreign country by charging service fee as determined by the Government of Nepal. The container with the goods shall be sealed, and the forms shall be certified. One copy of the certified form shall be handed over to the owner of goods, one copy shall be kept for office record and two copies of the forms shall be sent to the exporting Customs point.

(4) Upon receiving the goods by the export permitting Customs office, such office shall certify the forms pursuant to Sub- rule (2) and permit the export of such goods and send a copy of the certified copy to the import allowing Customs office.

(5) In case the goods are not exported pursuant to Sub-rule (3) using the transit of Nepal to another foreign country within the time period, the owner of goods shall apply before the Department for the extension of the time period stating the reason for the delay. Upon receiving the application and if the reason is found satisfactory, the Department may extend the time period.

(6) In case such imported goods are not exported within the prescribed time period and sold or used in Nepal, the owner of goods shall pay the due Customs duty as well as additional hundred percent Customs duty.

(7) While sending goods from one foreign country to another foreign country through Nepalese territory as per this Rule, sealed container shall be used.

7. Provisions relating to export or import of goods for repair:

(1) In case it becomes necessary to send any goods to a foreign country from Nepal for the purpose of repair or to bring such goods into Nepal from abroad after repair thereof, full particulars regarding the number, and size and specification of such goods, as far as possible, shall be filled up in the declaration form and submitted to the Customs officer.

(2) In case any declaration form as referred to in Sub-rule(1) is received, Customs officer may allow passage for such goods, after receiving deposits equivalent to 0.5 percent of the value of goods for aircraft, helicopters or spare parts thereof and 5 percent of the value for the other goods.

(3) Goods exported to foreign country for repair shall have to be brought back within Three months and Customs duty chargeable on the expenses involved in such repair or on the price of the spare parts which are replaced shall be deducted accordingly from the amount of the Customs deposit furnished and the balance of the deposit shall be refunded.

(4) In case time limit prescribed in Sub-rule (3) for bringing back such goods after repair is inadequate, an application accompanied with documentary evidence of such inadequacy shall be submitted to the Customs officer. The Customs officer may, if he/she so deems appropriate, extend the time limit by a period not exceeding three months. In case the additional time limit is inadequate, the Customs officer shall write to the Director General of the Department of Customs with the reasons and in case the Director General approves the extension of the time limit, the Customs officer shall extend the time period accordingly.

(5) If the goods exported for repair pursuant to this Rule are not brought back within the time limit prescribed under Sub-rule (3) and (4) rather brought back after the lapse of time limit, the deposited amount shall be seized and such goods shall be treated as fresh import and Customs duty shall be charged accordingly.

(6) In case it becomes necessary to bring any goods from a foreign country to Nepal for the purpose of repair or to send back such goods from Nepal to abroad after repair thereof, full particulars regarding the number, specification and size of such goods shall be filled up in the declaration form and submitted to the Customs officer.

(7) In case any declaration form as referred to in Sub-rule (6) is received, Customs officer may allow passage for such goods, after receiving deposits equivalent to the chargeable Customs duty and noting the time limit of 2 Six months for the export of such goods.

(8) If, the goods imported for repair is returned within 2 Six months time limit pursuant to Sub-rule (7), and the documentary evidence is presented for the payment of repair, the Customs duty deposited at the time of import shall be refunded. In case goods are not returned or the specification of the goods does not match with the goods that is presented for export or documentary evidence for the payment is not presented, such goods and the deposited amount at the time of importation shall be seized.

(9) In case airline company registered to operate airlines have to export engines of airplane or helicopter for repair and during the period of repair if the airway company has to import engine on rent from the foreign country, the company may import engine on bank guarantee equivalent to Customs duty in the Customs office and such import shall be for a maximum period of Six months. If the engine is exported within the period, the bank guarantee shall be released. If the engine is not exported within the period, the Customs duty shall be charged treating the engine as a fresh import.

(10) Notwithstanding anything contained in this Rule, on the recommendation of the Ministry of Foreign Affairs, the diplomatic mission may export to repair goods and import after repair without deposit and on record.

8. Re-export or Re-import of exported or imported goods:

(1) The purpose for which the goods have been imported, did not achieve the purpose or found to be sub-standard quality upon the laboratory test, the chief of Customs office may release duty free such goods for re – export within a period of Ninety days from the date of import or from the date of arrival at the Customs office on the condition that the similar goods are imported as replacement or the remittance of foreign exchange in Nepal in case payment in foreign exchange is already made on the import of such goods.

(2) If the goods have been re-exported as per Sub-rule (1), and the goods for replacement have not been imported or the foreign exchange paid for the goods have not been remitted within Six months from the date of re-export of goods, the concerned Customs officer shall write to the concerned office to take action in accordance with prevailing law of the land.

(3) In case the supplier has supplied the goods as replacement, before re-exporting the goods within the time limit as per Sub-rule(1), the Customs officer may release the goods levying the Customs duty after the scrutiny of the application of the importer and the documentary evidence of goods imported.

(4) In case the goods have been received as replacement as per Sub-rule (3), the goods to be re exported shall not attract the Customs duty or if the Customs duty was paid before, such Customs duty shall be refunded.

Provided that, in case the goods are re-exported after the lapse of the time limit, the Customs duty paid earlier shall not be refunded.

(5) In case it becomes necessary to export or import any goods for the purpose of sale or display at any seasonal market ( Haat Bazar ), or at any fair or exhibition inside or outside of Nepal the owner thereof shall indicate in the declaration form the purpose of such export or import and produce such goods at the Customs office.

(6) A deposit equivalent to the amount of the Customs duty due on the import or export of goods under Sub-rule (5) shall be collected.

(7) In case of goods exported or imported after sale at a seasonal market, fair or exhibition, the Customs office shall forthwith refund the deposit after deducting the amount which are not re- imported or re-exported as the case may be; provided such goods are brought in the customs offices the following day after the seasonal market, and within Thirty days excluding time consumed for transportation after the end of fair or exhibition.

(8) Except otherwise provided in this Rule, the Customs officer may release the goods without duty and keeping record only, in case the goods are exported or imported pursuant to this Rule and on the recommendation of the Government of Nepal or fully owned or majority owned government enterprises or the diplomatic mission. In case the goods exported are consumed in the foreign country or goods imported are consumed in Nepal, the concerned importer or exporter of goods shall pay the duty chargeable on the amount of goods consumed.

(9) In the course of export or the import of goods pursuant to this Rule it shall be done from the same Customs office.

(10) In case the import or the export of goods cannot take place from the same customs office pursuant to Sub-rule (9), the concerned person shall apply, stating the reasons thereof, at the Department. If the reasons stated in the application is found to be appropriate, the Department may allow the import or export of goods from different Customs office.

(11) In case of containers supplied for the use and transportation of such goods, for the repeated use of such goods, and as long as it is used the container cannot be emptied, the Customs officer may release container without charging Customs duty due after the furnishing of the bank guarantee for the Customs duty equivalent, and noting in the declaration form the time period for the return of such container. If the container is not returned within the specified time period, the Customs duty shall be deducted from the bank guarantee. Provided that, if the user of the goods who has contained in the container can transfer those good into any other container, this facility shall not be granted under this Sub-rule.

(12) If any industry imports goods from the empty container for the industry’s use and intends to export container for this purpose, the owner of goods shall apply to the Customs officer specifying the reasons.

(13) In case such application is received pursuant to Sub-rule (12), the Customs officer may permit the export of container on the conditions that five percent of the value of empty container is deposited in cash or bank guarantee equivalent to the amount valid for six months is furnished and the container is imported with the

goods within three months.

(14) If the container is not imported within the specified time period as per Sub-rule 13, the industry shall apply stating the reasons for the extension of time period. In case of such application, if the Customs officer found the reason justified, the chief of Customs office may extend the time period by One month.

(15) If the container is imported within the specified time period as per Sub-rule (14), by loading the goods by the industry, the Customs officer shall collect the chargeable Customs duty and refund the cash deposited earlier or release the furnished bank guarantee as per Sub-rule (13).

(16) In case the container is not imported within the specified time period as per Sub-rule (14) by the industry, the Customs officer shall transfer the deposited cash amount in the revenue account or forfeit the bank guarantee from the bank or the financial institutions. In case such container is imported after the elapse of the time period, the Customs officer shall transfer the deposited cash amount in the revenue account or forfeit the bank guarantee from the bank or the financial institutions and the goods contained in the container shall be cleared by charging the Customs duty.

(17) Any importer of the chassis of the bus or truck would like to export such chassis for the purpose of making body shall apply to the Customs officer enclosing the copy of declaration form at the time of import within the three months from the date of import.

(18) If the application is received as per Sub-rule (17), the Customs officer may permit the export of chassis on the condition that Five percent of the value of the chassis is deposited in cash or bank guarantee equivalent to the amount is furnished and the chassis with body is imported within Six months.

(19) If the chassis with body is imported within the specified time period as per Sub-rule (18), the Customs officer shall collect chargeable Customs duty on the expenditure made on the making of the body and refund the cash deposit or release the bank guarantee whatever the case may be.

(20) In case the chassis with body is not imported within the specified time period as per Sub-rule (18), the Customs officer shall transfer the deposited cash amount in the revenue account or forfeit the bank guarantee from the bank or the financial institutions. In case of re- import of chassis after the elapse of time period, the Customs officer shall transfer the deposited cash amount in the revenue account or forfeit the bank guarantee from the bank or the financial institutions and clear bus or truck by collecting duty on the value of making body of such bus or truck.